TL;DR Most SaaS founders are drowning in noise, mistaking "monitoring" for "intelligence." In this guide, we strip away the vanity metrics to rank the top 9 competitive intelligence tools for 2025. We also introduce a paradigm shift: why "intent recognition" and Agile CI are replacing static monthly reports. Whether you’re a bootstrapped indie hacker or an enterprise VP, you’ll find the exact tool stack to stop reacting and start counter-attacking.

Your Competitor Just Lowered Their Price, and You Missed the Signal

Imagine this: Your biggest rival just quietly A/B tested a new pricing tier that undercuts your "Pro" plan by 20%. They didn't announce it on TechCrunch. They didn't tweet about it. They just changed a few pixels on a landing page.

By the time you notice—three months later, after your churn rate inexplicably spikes—it’s too late. The market has shifted, and you’re playing catch-up.

This isn't a hypothetical nightmare; it's the reality for 90% of SaaS companies today. They are flying blind, reliant on anecdotal feedback from sales calls or sporadic manual checks. Data shows that companies who act on competitive shifts within 24 hours see a 30% higher win rate than those who react weekly.

The Old Way: The "Pixel-Peeping" Trap

For the last decade, SaaS Competitive Intelligence meant one of two things:

- The Intern Method: Paying a junior marketer to manually screenshot pricing pages and paste them into a stale Google Doc.

- The Noise Factory: Using legacy tools like Visualping that alert you every time a competitor fixes a typo or updates a copyright footer.

This approach is fundamentally broken. It prioritizes volume over value. You get 500 alerts a week, 499 of which are useless noise. This leads to alert fatigue, where critical strategic shifts—like a change in positioning messaging or a new integration partnership—get buried in the trash folder. You aren't making decisions; you're just hoarding data.

The New Way: Agile CI and Intent Recognition (The Lensmor Methodology)

We are entering the era of Agile Competitive Intelligence. This isn't about tracking pixels; it's about tracking intent.

At Lensmor, we analyzed over 1,000 SaaS growth trajectories and found a clear pattern: the winners don't just watch; they predict. They use intent recognition—identifying why a competitor made a change—to formulate an immediate counter-move.

Instead of a report saying "Competitor X changed their H1 tag," Agile CI tells you: "Competitor X just shifted positioning from 'All-in-one' to 'Enterprise-focused.' Action Plan: Double down on your SMB-friendly messaging in your next ad campaign."

This is the Lensmor Methodology:

- Signal Detection: AI filters out the noise (typos, code updates).

- Intent Decoding: Understanding the strategic move behind the change.

- Action Plans: Delivering a specific playbook to counter the move.

The 9 Best Competitor Intelligence Tools for SaaS in 2025

We’ve tested the market leaders to bring you this definitive, opinionated list. We’ve ranked them not just by features, but by strategic value.

Quick Comparison: The 2025 Market Intelligence Stack

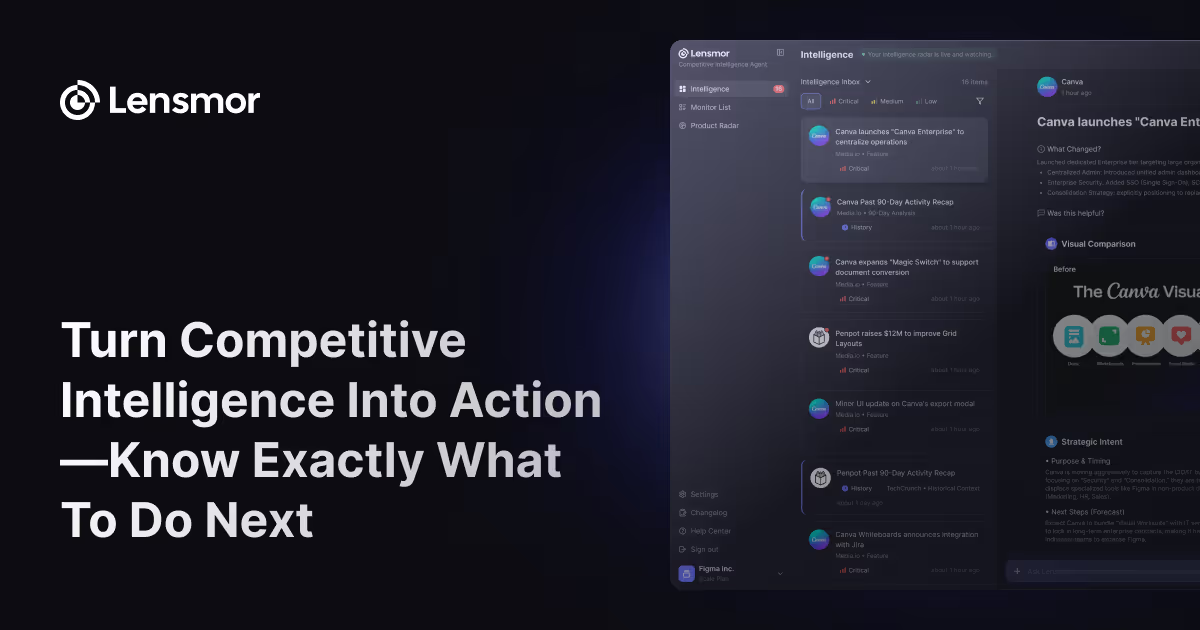

1. Lensmor

Best for: Growth SaaS companies and Agile teams who want Action Plans, not just data.

Lensmor isn't just a monitoring tool; it's an AI-powered Competitive Agent. While legacy tools dump raw data on your lap, Lensmor focuses on the "So What?" factor. It uses proprietary algorithms to filter out 98% of the noise, ensuring you only get alerted on high-impact changes like pricing structure shifts, new feature rollouts, or subtle messaging pivots.

Why It’s a Game Changer:Most tools stop at "detection." Lensmor pushes into "execution." If a competitor launches a copycat feature, Lensmor doesn't just email you; it suggests a specific Action Plan based on the <The Age of Agile Intelligence: Why Static Competitive Strategy is Dead in 2026>.

Key Features:

- Intent Recognition Engine: Distinguishes between a minor tweak and a strategic pivot.

- AI Action Plans: Automated suggestions on how to counter specific competitor moves.

- Noise Cancellation: Filters out false positives like CSS changes or bug fixes.

- Growth-First Pricing: Built for agile teams, not just Fortune 500 budgets.

Data-Driven Verdict: Early users report saving 15+ hours a week on manual research while increasing reaction speed by 4x.

Pricing: Join the Waitlist for 50% OFF.

2. Crayon

Best for: Mid-market to Enterprise companies needing a human-touch approach.

Crayon combines software with human analysis. It’s the heavyweight champion for teams that have the budget to outsource their thinking. It tracks everything—from Glassdoor reviews to patent filings.

Why Industry Insiders Use It:If you are managing Market Intelligence Tools for a large organization, Crayon’s internal "boards" allow for cross-departmental collaboration that is hard to beat. However, be warned: for smaller teams, the sheer volume of data can be paralyzing without a dedicated analyst.

Pricing: Custom (Typically $15k - $30k/year).

3. Klue

Best for: Product Marketing teams focused purely on Sales Enablement.

Klue creates "Battlecards"—cheat sheets for your sales team. When a prospect mentions a competitor on a call, Klue ensures your rep knows exactly what to say to kill the objection.

Why It Works:Data shows that sales confidence correlates directly with win rates. Klue excels at collecting "tribal knowledge" from your Slack channels and turning it into official company intel. It’s less about "what the competitor changed on their site" and more about "how we beat them in the room."

Pricing: Custom (Enterprise focused).

4. Kompyte

Best for: Teams that want to automate the distribution of intel.

Now part of Semrush, Kompyte focuses heavily on automation. It’s great if you need to feed competitive data directly into HubSpot or Salesforce without manual intervention.

The Insider Take:Kompyte is solid, but it can feel like a "feature" of Semrush rather than a standalone platform at times. It’s perfect if you are already deep in the Semrush ecosystem for Competitor Analysis.

Pricing: Custom.

5. SEMrush

Best for: SEO and Content Marketing warfare.

While SEMrush is primarily known as an SEO tool, its competitor intelligence capabilities are seriously underrated. It's perfect for SaaS companies that compete heavily in organic search and content marketing. The depth of keyword and traffic data makes it indispensable for understanding how competitors are winning in search.

You can't talk about SaaS Competitive Intelligence without mentioning the king of SEO. SEMrush doesn't track pricing pages well, but it tells you exactly where your competitors are getting their customers.

Why You Need It:If your competitor’s traffic suddenly spikes, SEMrush will tell you it’s because they just captured the "AI CRM" keyword. This is tactical intelligence at its finest.

Pricing: Starts from $199/mo

6. Contify

Best for: Tracking broad industry trends and news.

Contify is an aggregation engine. It pulls from news sites, press releases, and social media to give you a macro view of the market. It’s less about "they changed their button color" and more about "they just acquired a smaller competitor."

Pricing: Custom.

7. Owler

Best for: Startups on a shoestring budget.

Owler is the "Yelp" of company data. It relies on a community of users to update revenue numbers and employee counts.

The Reality Check:It’s great for a quick glance, but don't build your strategy on it. The data is often outdated or estimated. Use it to check if a competitor is still alive, not to decide your pricing strategy.

Pricing: Free tier available; Pro plans start at $39/month

8. SimilarWeb

Best for: Uncovering traffic sources and audience demographics.

SimilarWeb answers one question: "Where are they getting their users?" It breaks down referral traffic, display ad spend, and social engagement.

Why It Matters:If you see your competitor is getting 40% of their traffic from a specific referral partner, you have a clear Action Plan: go steal that partner.

Pricing: Free limited tier; Paid starts ~$125/month.

9. PeerPanda

Best for: E-commerce and simple monitoring.

A newer entrant focused on simplicity. It does the basics of website monitoring well but lacks the deep "intent" analysis of tools like Lensmor or Crayon. Good for "set and forget" use cases where Competitive Monitoring is a secondary priority.

Pricing: Free limited tier; Pro plans start at $29/month

The Action Plan: How to Build Your Agile CI Stack

Don't just buy a tool and hope for the best. Follow this 3-step framework to build a winning intelligence engine.

Step 1: The Audit (Day 1-3)Identify your top 5 direct competitors. Don't waste time on the small fry. Use Lensmor to set up "Intent Monitors" on their Pricing, Features, and Home pages. Read our guide on <How to Do Competitive Analysis for Al SaaS: A Real-World Guide (Case Study: Lovart)> to get the specific parameters right.

Step 2: The Loop (Weekly)Establish a "SaaS OODA Loop" (Observe, Orient, Decide, Act). Every Monday, review the high-priority alerts. If a competitor launches a feature you don't have, decide immediately: do we Copy, Counter, or Ignore? (See: <Why Copying Competitors Will Kill Your Startup: The 'Feature Parity' Trap>).

Step 3: The Counter-Attack (Quarterly)Use the aggregated data to find macro weaknesses. Are they consistently raising prices? That’s your opening to launch a "Switch & Save" campaign. Use insights from <7 Real-World Competitive Counter-Moves (And How to Execute Them)> to draft your quarterly strategy.

FAQs: Mastering Competitive Intelligence

Q: Is "spying" on competitors unethical?

A: Absolutely not. Analyzing public data is standard business practice. We are talking about monitoring public websites and APIs, not corporate espionage. The unethical move is ignoring the market and failing your customers.

Q: How is Lensmor different from just using Visualping?

A: Visualping is a "diff" tool—it tells you pixels changed. Lensmor is an "intelligence" tool—it tells you meaning changed. Visualping will alert you if a timestamp updates; Lensmor alerts you if the pricing model shifts from Flat Rate to Usage-Based.

Q: Can’t I just use ChatGPT to analyze competitors?

A: ChatGPT has a knowledge cutoff and can't browse live sites autonomously to track changes over time. You need a dedicated crawler combined with LLM analysis—which is exactly what the Lensmor engine is built to do.

Conclusion: Stop Monitoring, Start Winning

The era of passive "FYI" reports is over. In 2025, the winner isn't the one with the most data; it's the one with the fastest Time-to-Action.

You can stick to the Old Way—manual spreadsheets and anxiety-inducing noise—or you can adopt the Agile CI methodology. The tools listed above cover every budget and use case, but if you want to turn intelligence into revenue, you need to look beyond simple tracking.

Ready to upgrade your intelligence stack?Stop guessing what your competitors are up to. Get the insights you need to win.