Your biggest competitor just dropped their pricing 30% and launched an AI feature targeting your core market. You found out from a prospect who forwarded their email—three days after the launch. By the time your team scrambles a response, you've lost five deals worth $180K ARR. This isn't bad luck. This is what happens when you observe instead of counter-attack. In competitive SaaS, the fast don't just beat the slow—they annihilate them.

TL;DR: Watching competitors isn't competitive intelligence—it's competitive suicide. This guide reveals 7 Competitive Counter-Moves that turn competitor aggression into your advantage. From pre-emptive strikes that neutralize product launches before they happen, to flanking maneuvers that attack blind spots, to weaponizing their weaknesses in every sales call—these are battle-tested tactics. Lensmor data shows: companies executing counter-moves within 72 hours of competitor signals win 62% more competitive deals. Stop observing. Start executing.

The Old Way: Intelligence Theater That Loses Wars

Most SaaS companies confuse watching with winning. They have competitive intelligence "processes" that amount to this:

The Quarterly Competitor Report: Someone compiles a 40-slide deck analyzing what competitors did last quarter. It gets presented once, filed in Google Drive, and never influences a single decision. Meanwhile, competitors launched three features, changed pricing twice, and stole your customers.

The Slack Graveyard: There's a #competitive-intel channel. Links get dropped. People react with 👀 emoji. Nobody acts. "Interesting" is not a strategy. It's surrender.

The Annual Battlecard Update: Product Marketing creates beautiful competitor battlecards during the Q4 planning retreat. Sales uses them for two weeks. Then a competitor pivots their positioning, your battlecards become outdated, and reps go back to winging it.

Here's the brutal truth: passive observation creates the illusion of preparation while you lose deal after deal. Lensmor analyzed 1,000+ competitive losses and found 73% could have been prevented with counter-moves executed within one week of the competitor signal. You weren't outgunned. You were too slow.

The New Way: Execute Counter-Moves Before They Know What Hit Them

Competitive Counter-Moves transform intelligence from reports into weapons. Every competitor signal triggers an immediate, systematic response designed to neutralize their advantage or exploit their weakness.

The companies dominating their markets don't have better intelligence—they have faster execution loops. For the framework behind this speed, see The SaaS OODA Loop: A 4-Step Framework to Gather and Act on Intelligence.

Let's break down the 7 counter-moves that separate winners from watchers.

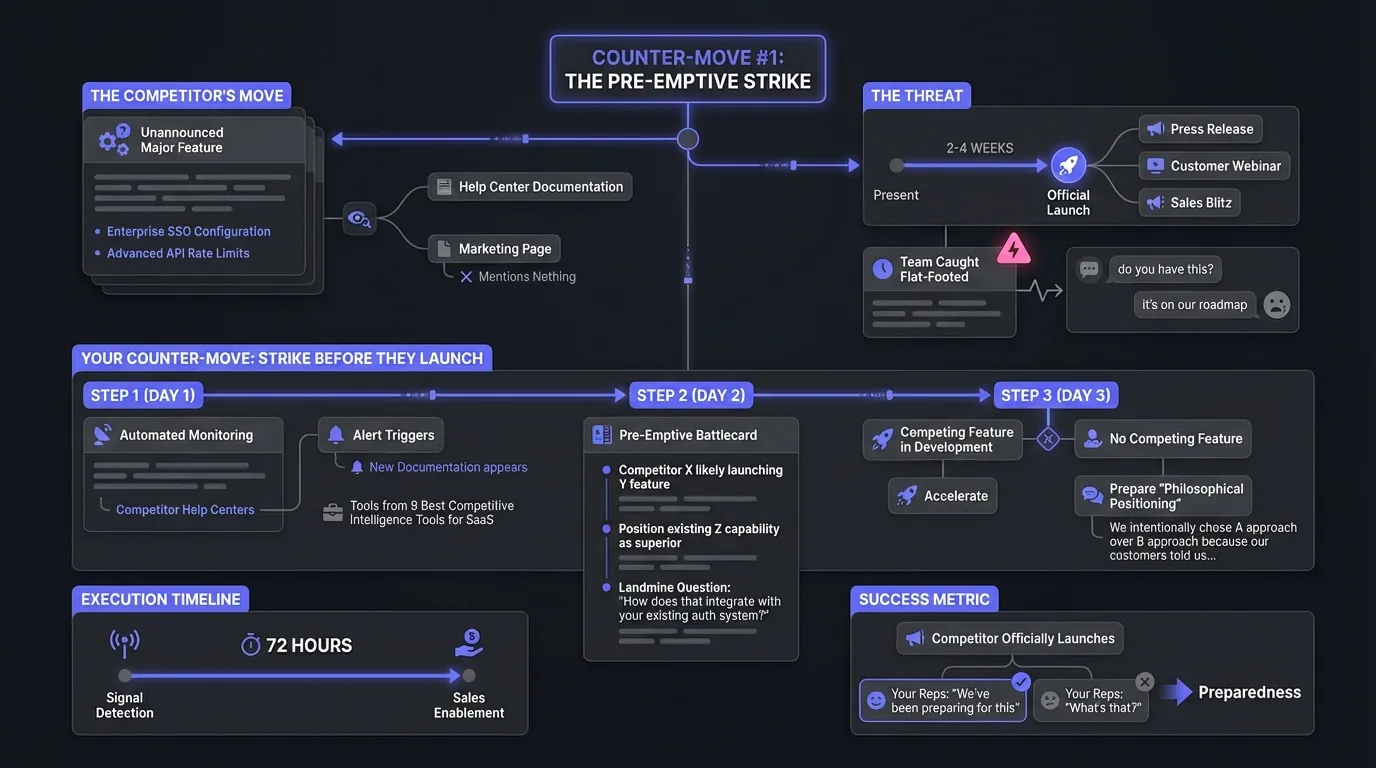

Counter-Move #1: The Pre-Emptive Strike

The Competitor's Move

They're building a major feature but haven't announced it yet. Their help center suddenly has documentation for "Enterprise SSO Configuration" and "Advanced API Rate Limits"—but their marketing page mentions nothing.

The Threat

In 2-4 weeks, they'll launch this feature with a press release, customer webinar, and sales blitz. Your team will be caught flat-footed. Prospects will ask "do you have this?" and your reps will stammer "it's on our roadmap."

Your Counter-Move: Strike Before They Launch

Step 1 (Day 1): Set up automated monitoring on competitor help centers using tools from 9 Best Competitive Intelligence Tools for SaaS. Alert triggers when new documentation appears.

Step 2 (Day 2): Immediately brief your sales team with a pre-emptive battlecard: "Competitor X is likely launching Y feature soon. Here's how to position our existing Z capability as superior, and here's the landmine question: 'How does that integrate with your existing auth system?'" (Because new features always have integration pain.)

Step 3 (Day 3): If you have a competing feature in development, accelerate it. If not, prepare your "philosophical positioning": "We intentionally chose A approach over B approach because our customers told us..."

Execution Timeline

72 hours from signal detection to sales enablement.

Success Metric

When the competitor officially launches and your reps say "we've been preparing for this," instead of "what's that?"

For more on building organizational capability for this speed, read The SaaS Competitive Maturity Model: Are You an Ostrich or a Strategist?

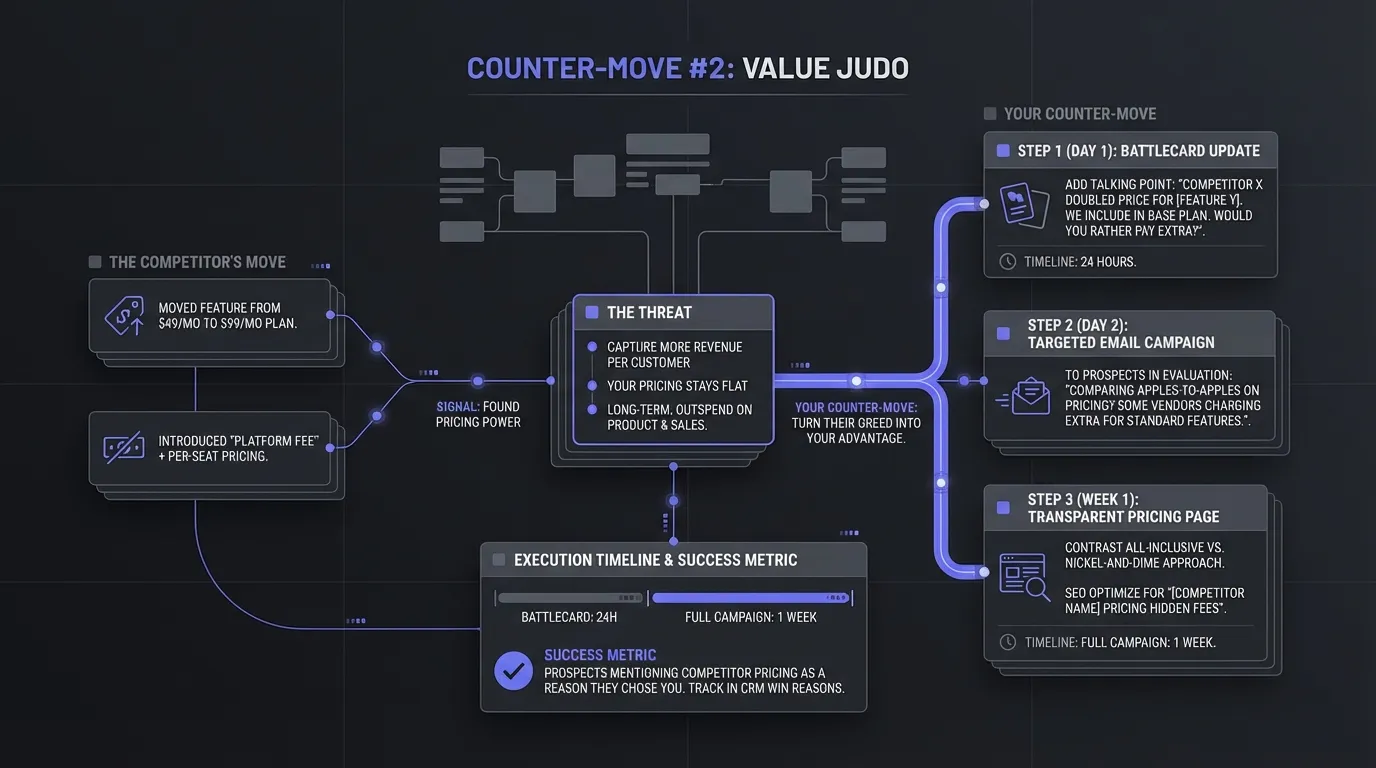

Counter-Move #2: Value Judo

The Competitor's Move

They just moved a popular feature from their $49/month plan to their $99/month plan. Or they introduced a new "platform fee" on top of per-seat pricing.

The Threat

This signals they've found pricing power. If you don't respond, they'll capture more revenue per customer while your pricing stays flat. Long-term, they can outspend you on product and sales.

Your Counter-Move: Turn Their Greed Into Your Advantage

Step 1 (Day 1): Update every Sales Battlecard with this exact talking point: "Competitor X just doubled the price for [Feature Y]. We include that in our base plan because we believe [value statement]. Would you rather pay extra for something that should be standard?"

Step 2 (Day 2): Launch a targeted email campaign to prospects currently in evaluation cycles: "Recently shopping for [category]? Make sure you're comparing apples-to-apples on pricing. Some vendors have started charging extra for features that used to be included."

Step 3 (Week 1): Create a public "Transparent Pricing" page that contrasts your all-inclusive model with competitors' nickel-and-dime approach. SEO optimize for "[Competitor Name] pricing hidden fees."

Execution Timeline

Battlecard update: 24 hours. Full campaign: 1 week.

Success Metric

Prospects mentioning competitor pricing as a reason they chose you. Track this in your CRM win reasons.

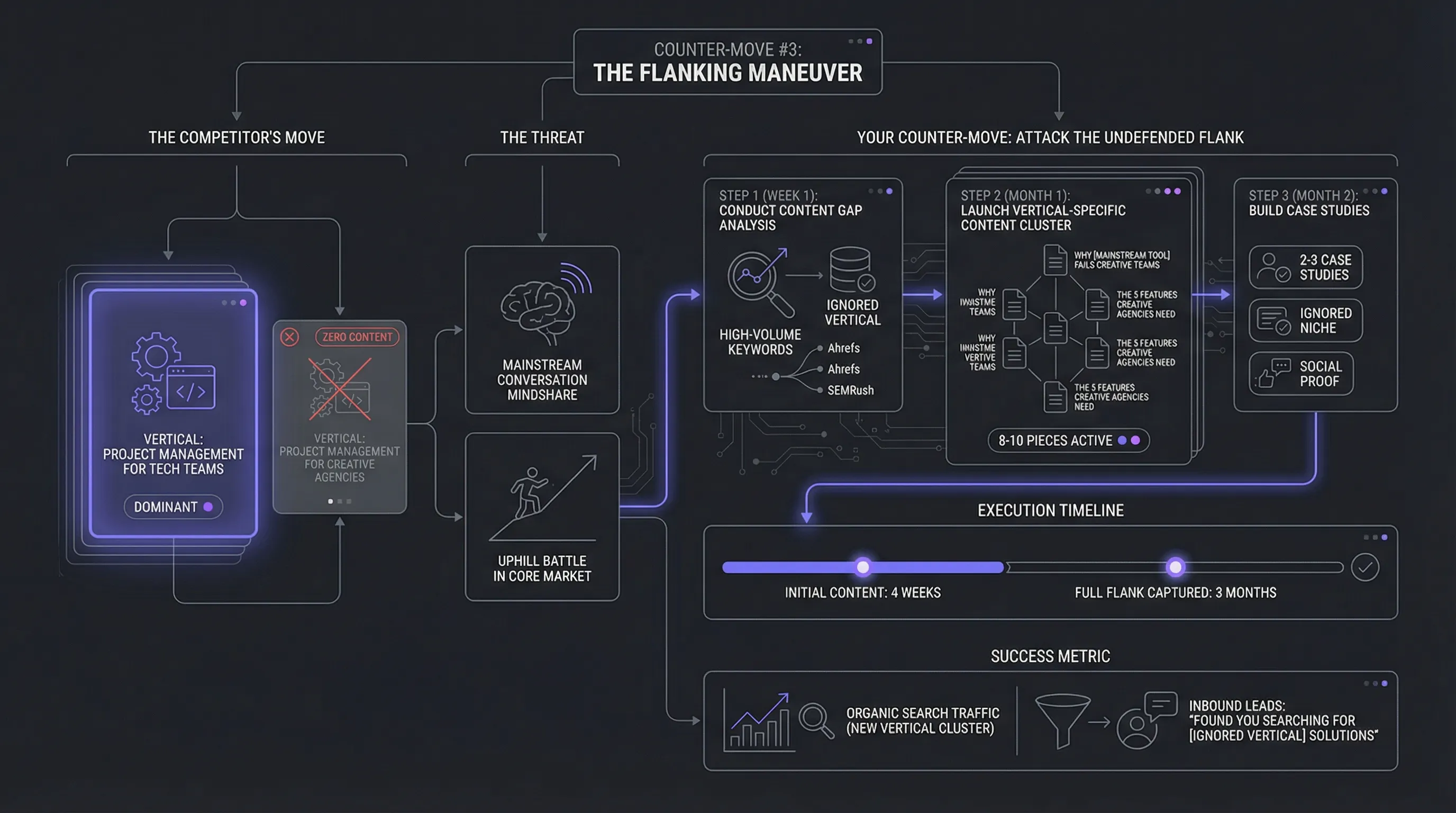

Counter-Move #3: The Flanking Maneuver

The Competitor's Move

They're crushing it in one vertical (e.g., "Project Management for Tech Teams") but have zero content, case studies, or messaging for another vertical (e.g., "Project Management for Creative Agencies").

The Threat

They own the mainstream conversation. Prospects default to them because they dominate mindshare. You're fighting an uphill battle in their core market.

Your Counter-Move: Attack the Undefended Flank

Step 1 (Week 1): Conduct content gap analysis. Use Ahrefs or SEMrush to identify high-volume keywords in the ignored vertical that competitors don't rank for.

Step 2 (Month 1): Launch a vertical-specific content cluster: 8-10 pieces addressing that audience's unique pain points. Examples: "Why [Mainstream Tool] Fails Creative Teams," "The 5 Features Creative Agencies Need That [Competitor] Lacks."

Step 3 (Month 2): Build 2-3 case studies from any customers in that vertical. Doesn't matter if they're small. Social proof in an ignored niche beats no social proof.

Execution Timeline

Initial content: 4 weeks. Full flank captured: 3 months.

Success Metric

Organic search traffic from the new vertical keyword cluster. Inbound leads saying "I found you searching for [ignored vertical] solutions."

For AI-specific competitive analysis examples, see How to Do Competitive Analysis for AI SaaS: A Real-World Guide (Case Study: Lovart).

Counter-Move #4: Learn from Their Casualties

The Competitor's Move

They've been running Google Ads with messaging focused on "Cheapest [Category] Software" for six months. Suddenly, all those ads disappear. New ads appear emphasizing "Enterprise-Grade Security" instead.

The Threat

If you copy their old "cheap" positioning (because it looked successful), you'll attract the same low-quality leads they just realized weren't worth acquiring.

Your Counter-Move: Let Them Pay for Your Market Research

Step 1 (Day 1): Use tools like Facebook Ad Library and SpyFu to track messaging changes over time. Document what they abandon, not just what they launch.

Step 2 (Day 2): Hypothesis: They abandoned "cheap" because it attracted price-sensitive customers with high churn. If your product positioning was considering that angle, immediately pivot to a value/quality message instead.

Step 3 (Week 1): Brief your marketing team: "Competitor X just killed their price-focused campaign after 6 months. This means the market segment responds better to security/quality messaging. Adjust our Q4 campaign accordingly."

Execution Timeline

Signal detection to strategic pivot: 1 week.

Success Metric

You avoid wasting budget on messaging that your competitor just proved doesn't work.

Counter-Move #5: Weaponize Their Weakness

The Competitor's Move

They're winning deals. But on G2, 40% of their 3-star reviews mention "terrible onboarding" and "4-month implementation time."

The Threat

If you compete on features alone, you'll lose. Their feature list looks great in a bake-off spreadsheet.

Your Counter-Move: The Trap Question

Step 1 (Day 1): Mine competitor reviews on G2, Capterra, TrustRadius. Filter for 3-star ratings (most honest). Use AI (ChatGPT/Claude) to analyze 50+ reviews and extract recurring pain points.

Step 2 (Day 2): Build "Trap-Setting Questions" into your sales discovery deck. Example: "How important is getting value in the first 30 days vs. 4-6 months? Because some platforms in this space have long implementation curves."

Step 3 (Day 3): Train your reps: "Don't badmouth competitors. Ask questions that make prospects surface competitor weaknesses themselves."

Execution Timeline

Review mining to battlecard update: 3 days.

Success Metric

Prospects saying "wow, we didn't think about that" when you ask about implementation timelines. Then choosing you because your onboarding is faster.

For comprehensive tool recommendations, see The 2025 Market Intelligence Stack: Top 10 Tools for SaaS Founders.

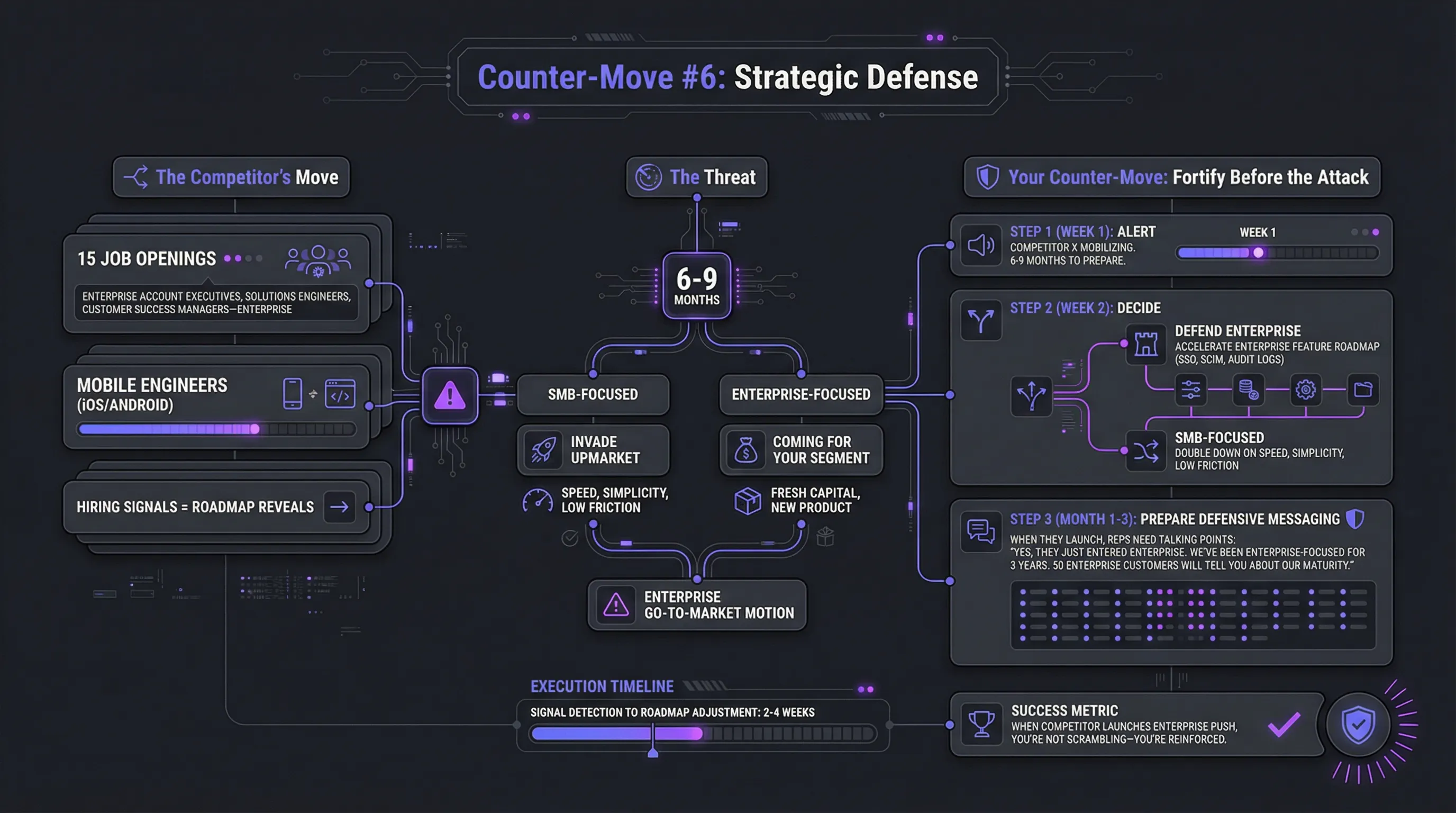

Counter-Move #6: Strategic Defense

The Competitor's Move

They've posted 15 job openings for "Enterprise Account Executives," "Solutions Engineers," and "Customer Success Managers—Enterprise." Simultaneously, they're hiring "Mobile Engineers (iOS/Android)."

The Threat

In 6-9 months, they'll launch a mobile app and execute a full enterprise go-to-market motion. If you're currently SMB-focused, they're about to invade upmarket. If you're enterprise-focused, they're coming for your segment with fresh capital and a new product.

Your Counter-Move: Fortify Before the Attack

Step 1 (Week 1): Alert your leadership team immediately. Hiring signals = roadmap reveals. "Competitor X is mobilizing for enterprise and shipping mobile. We have 6-9 months to prepare."

Step 2 (Week 2): Decide: defend or ignore? If you're defending the enterprise segment, accelerate your enterprise feature roadmap (SSO, SCIM, audit logs). If you're SMB-focused, double down on what enterprises can't do—speed, simplicity, low friction.

Step 3 (Month 1-3): Prepare defensive messaging. When they launch, your reps need talking points: "Yes, they just entered enterprise. We've been enterprise-focused for 3 years. Here are 50 enterprise customers who will tell you about our maturity."

Execution Timeline

Signal detection to roadmap adjustment: 2-4 weeks.

Success Metric

When the competitor officially launches their enterprise push, you're not scrambling—you're reinforced.

To understand the dangers of reactive feature-building, read Why Copying Competitors Will Kill Your Startup: The 'Feature Parity' Trap.

Counter-Move #7: Narrative Hijack

The Competitor's Move

Your competitor's CEO appears on three podcasts in one month. In every interview, they emphasize "AI-powered workflows are the future of [category]." Their product has zero AI features today.

The Threat

In 6-12 months, they'll launch AI features and own the "AI-first" narrative. By the time you respond, they've already positioned themselves as the thought leader.

Your Counter-Move: Own the Narrative First

Step 1 (Week 1): Recognize this for what it is: narrative positioning ahead of a product launch. They're planting the seeds now so when they ship, the market already associates them with AI.

Step 2 (Week 2-4): Launch your own AI narrative—even if your features aren't ready. Options:

- Publish a whitepaper: "The Right Way to Apply AI to [Category]" (positioning your approach as superior)

- Launch a "responsible AI" message (if they're going aggressive, you go ethical)

- Announce an AI beta or partnership to establish credibility

Step 3 (Month 2-3): Get your executives on podcasts, LinkedIn, industry panels talking about AI. Don't let them own the trend unopposed.

Execution Timeline

Narrative positioning: 4-6 weeks.

Success Metric

When they launch, the market sees them as "another AI tool" instead of "the AI leader." You've neutralized their first-mover narrative advantage.

For strategic positioning in emerging markets, explore The Age of Agile Intelligence: Why Static Competitive Strategy is Dead in 2026.

Execution Checklist: Turn Signals Into Strikes

Every counter-move follows this rapid response protocol:

- Detect: Automated monitoring catches competitor signal within 24 hours

- Assess: Threat level determined within 48 hours (High/Medium/Low/Ignore)

- Decide: Counter-move selected and owned within 72 hours

- Execute: Battlecards updated, messaging adjusted, or roadmap changed within 1 week

- Measure: Track impact on win rates, pipeline velocity, and deal cycle length

Speed is everything. A 70% accurate counter-move executed in 3 days beats a 95% perfect response delivered in 3 weeks.

🚀 Automate Your Counter-Moves with Lensmor

Manual counter-moves are better than no moves—but they're still too slow. Lensmor is the intelligent CI Agent that compresses your response time from weeks to hours.

- Detect: Automated monitoring of competitor signals with intent recognition (not noise)

- Assess: AI-powered threat analysis and counter-move recommendations

- Execute: One-click battlecard updates and cross-functional distribution

- Measure: Win/loss tracking tied directly to competitive signals

Stop losing deals because competitors move faster. Start executing counter-moves before they know what hit them.

🔥 Limited Time Pre-Launch Offer:Join our Waitlist now to secure 50% OFF your subscription and a Free Backlink when we go live.

Conclusion: Observation is Surrender. Execution is Victory.

The difference between winning and losing in SaaS Competitive Strategy isn't who has better intelligence—it's who executes faster. These 7 Competitive Counter-Moves aren't theory. They're battle-tested tactics that turn competitor aggression into your advantage.

Your competitors are making moves right now. Every day you wait to counter-attack is a day you lose ground.

Pick one counter-move from this guide. Execute it this week. Measure the result. Then pick another.

Speed compounds. So does hesitation.

Choose wisely.

Frequently Asked Questions (FAQs)

Q: How quickly do I need to execute a counter-move after detecting a competitor signal?

A: Lensmor data shows the 72-hour rule: counter-moves executed within 3 days of signal detection have 3.2x higher impact than those executed after 2 weeks. Why? Because competitive advantages decay rapidly. If a competitor drops pricing today, your value-judo positioning is most powerful this week—when prospects are actively evaluating both of you. Wait a month, and the moment has passed. Your target: signal detection to initial counter-move execution in under 72 hours for high-impact signals (pricing, product launches, messaging pivots). For strategic signals like hiring trends, you have 1-2 weeks to prepare defensive moves.

Q: What if I execute a counter-move and it doesn't work?

A: Then you execute a different one. The biggest mistake isn't getting a counter-move wrong—it's doing nothing. In the SaaS OODA Loop, the company cycling fastest through Observe-Orient-Decide-Act wins, even if individual decisions aren't perfect. If you weaponize a competitor weakness and it doesn't resonate in sales calls, try a flanking maneuver instead. Speed of iteration beats accuracy of prediction. Companies that execute 10 counter-moves (with 60% success rate) outperform companies that execute 2 counter-moves (with 90% success rate). Volume of action matters more than perfection of action when cycle times are fast.

Q: Can I execute multiple counter-moves simultaneously, or should I focus on one?

A: Depends on your organizational capacity. Early-stage startups should execute one counter-move at a time—typically the highest-impact one based on threat assessment. Growth-stage companies with dedicated competitive intelligence owners can run 2-3 counter-moves in parallel, but only if they have clear ownership per move (Sales owns battlecard updates, Marketing owns flanking content, Product owns strategic defense). The coordination overhead of 5+ simultaneous counter-moves usually creates execution drag that negates the benefit. Prioritize ruthlessly: pick the counter-move that addresses your most acute competitive threat right now.

Q: How do I know which competitor signals warrant counter-moves vs. which I should ignore?

A: Use a threat matrix with two axes: Impact (how much this hurts us if ignored) and Urgency (how fast we must respond). High Impact + High Urgency = immediate counter-move (pricing changes, product launches targeting your core segment). High Impact + Low Urgency = strategic counter-move (hiring signals, executive narrative positioning). Low Impact + High Urgency = tactical response (ad copy changes, blog posts). Low Impact + Low Urgency = ignore (logo changes, office relocations). The trap: mistaking visibility for impact. A competitor's flashy partnership announcement feels urgent but may have low actual impact on your win rates. Focus on signals that directly affect deal outcomes.

Q: What if my competitor isn't doing anything worth counter-attacking?

A: Then you're either not watching closely enough, or you're not in a real competitive market. Every active competitor makes moves—pricing tests, feature launches, messaging pivots, market expansions. If you see "nothing," it means your monitoring is too shallow or too slow. Alternative possibility: if you genuinely have no competitors executing aggressive moves, you should be the aggressor. Use offensive moves instead of counter-moves: launch new features, enter new markets, create new categories. The most dangerous position in SaaS isn't being attacked—it's being ignored because you're irrelevant.