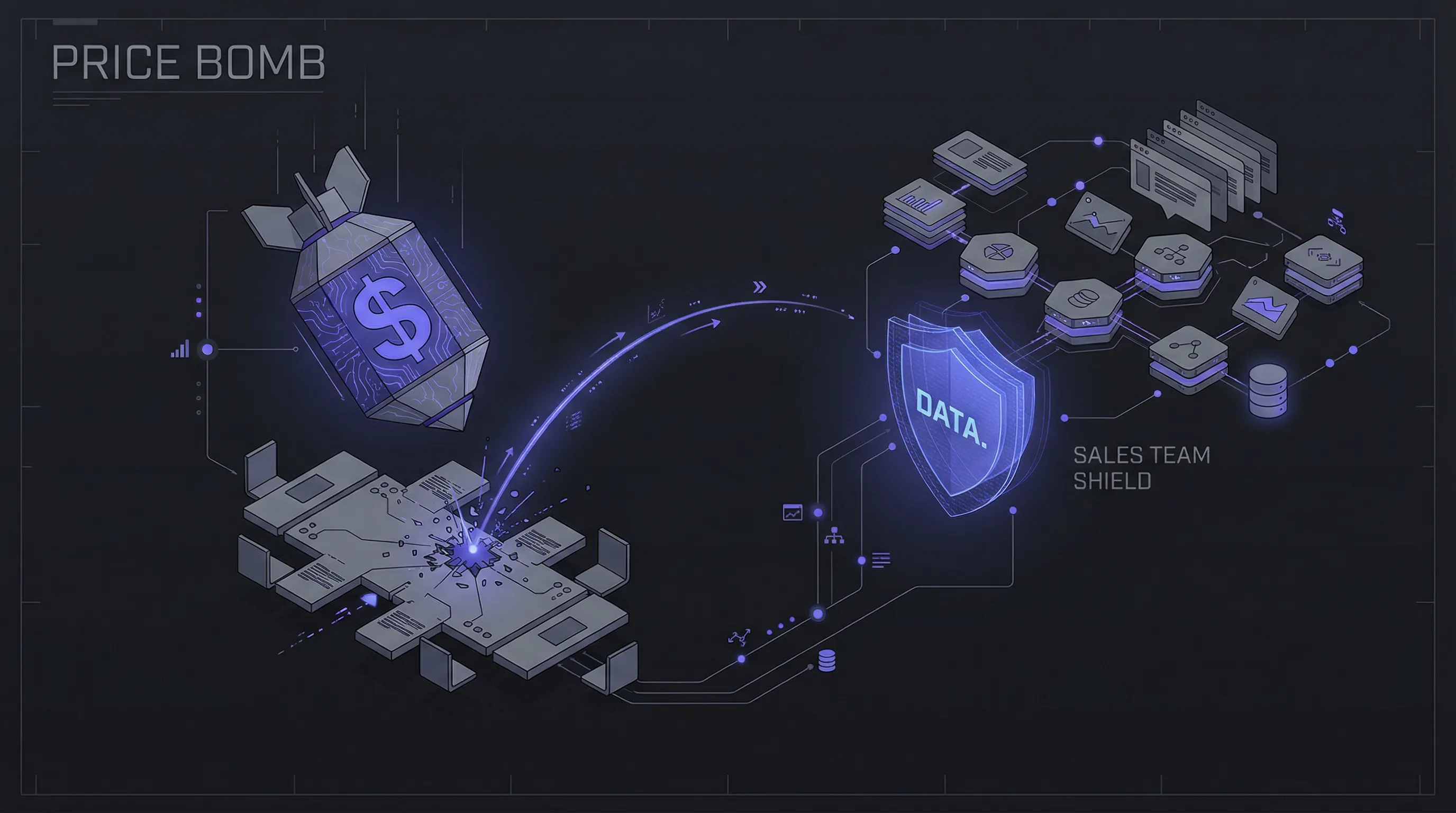

TL;DR: If you are hearing "Competitor X is cheaper" more than twice a week, your sales team is bleeding revenue. Most founders think this is a pricing problem; it isn’t. It’s an intelligence problem. Relying on static PDFs or mental notes is the "Old Way" that leads to discounting wars. This post breaks down the Battlecard strategy you need to win. We provide three specific, battle-tested scripts to counter price objections, explain why dynamic intelligence beats static screenshots, and offer a downloadable template to standardize your wins.

You’ve done the demo. The prospect nodded along. The solution fit is perfect. Then comes the silence, followed by the email that kills 30% of SaaS deals:

"We really like your platform, but Competitor X is offering a similar package for 40% less. Can you match it?"

Your sales rep panics. They slack you for a discount code. You erode your margins to save the deal.

Stop doing this.

After analyzing over 1,000 B2B SaaS negotiation cycles, Lensmor found that 78% of price objections are not about affordability—they are about a lack of perceived differentiation. When a prospect brings up a cheaper competitor, they are handing you an opportunity, not a rejection.

But you can’t win this argument with improvisation. You need a structured, data-driven Battlecard.

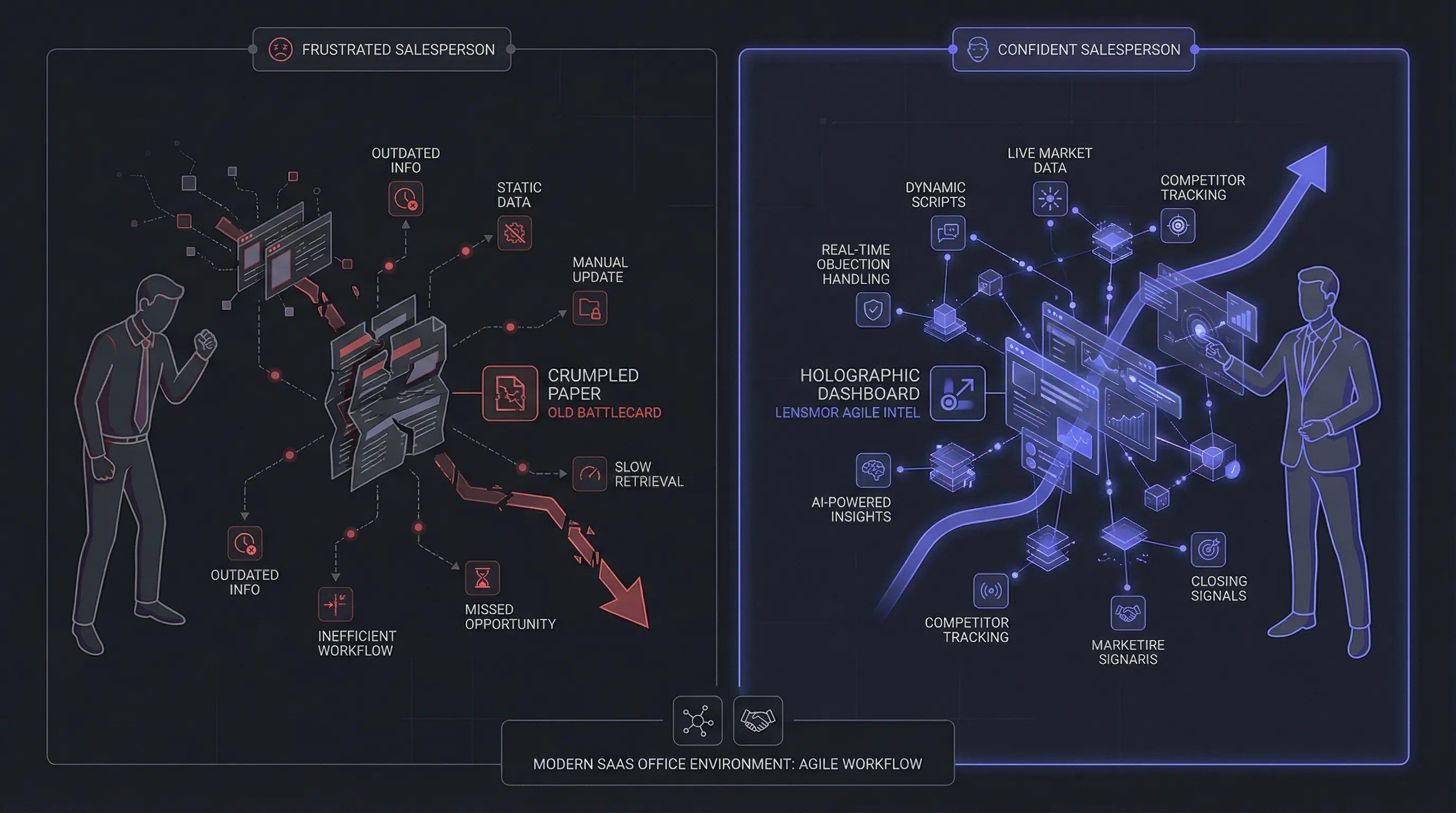

The Old Way: Static PDFs and "Feature Parity" Arguments

Traditionally, marketing teams create a static "Us vs. Them" PDF stored in Google Drive. This document usually lists features with green checkmarks for you and red X’s for the competitor.

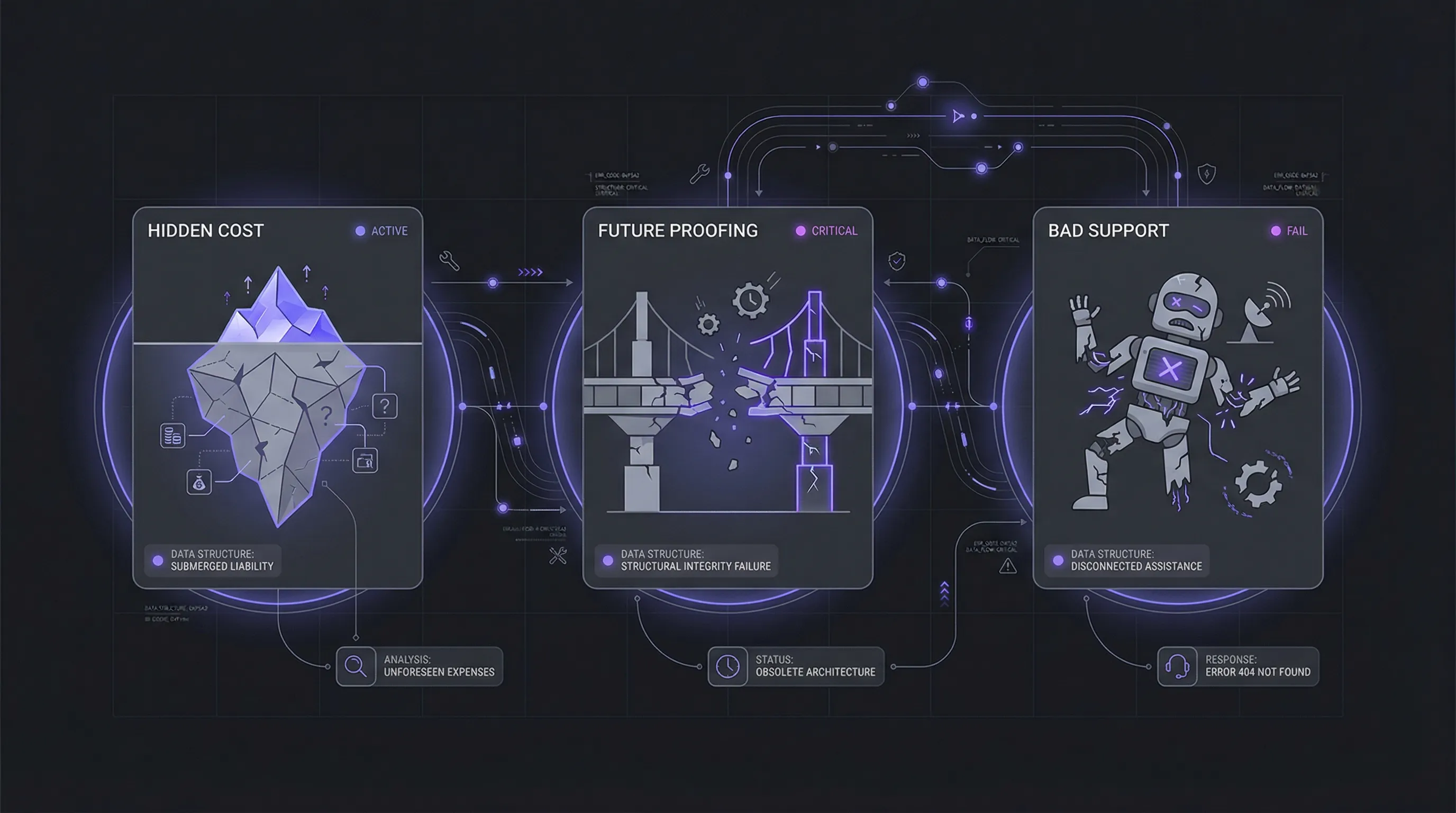

This approach is dead on arrival for two reasons:

- It’s Outdated Instantly: Competitors change pricing and packaging weekly. If your team is using a Battlecard from last quarter, they are lying to the prospect.

- It Ignores Intent: Tools like Visualping might tell you a competitor changed a pixel on their pricing page, but they don't tell you why. Is the competitor desperate? Are they sunsetting a feature? Did they pivot to a lower-tier market?

When you rely on static data or generic monitoring, you fall into the Feature Parity Trap. You argue about buttons and widgets, which commoditizes your product. When products look identical, the cheapest one wins.

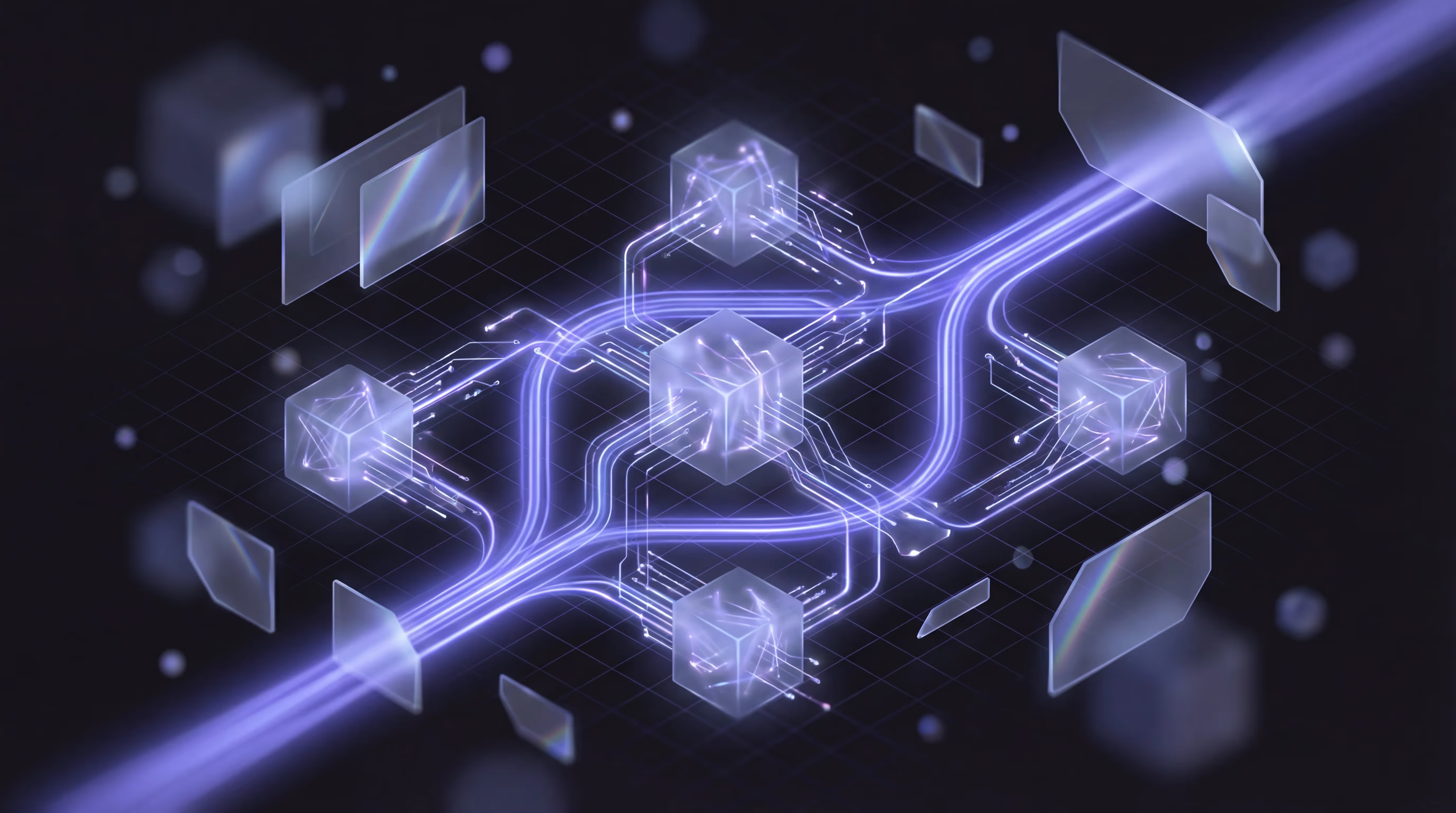

The New Way: Agile Intelligence and Dynamic Battlecards

The Lensmor Methodology shifts from static monitoring to Agile Competitive Intelligence.

Instead of just knowing that a competitor is cheaper, you need to know the trade-off hidden behind that price tag. A robust Battlecard doesn't just list features; it provides "Intent Recognition."

- Is their price lower because they lack enterprise security?

- Is it lower because their support is entirely bot-driven?

- Is it lower because they are burning cash to buy market share before a jagged price hike?

You must arm your sales team with "Action Plans"—specific scripts derived from this intelligence.

The Action Plan: 3 Scripts to Crush Price Objections

Do not let your reps improvise. Use these three scripts, which should be embedded in every Battlecard your team uses.

Script 1: The "Hidden Cost" Pivot (The TCO Argument)

When to use it: When the prospect is fixated on the monthly subscription fee rather than the Total Cost of Ownership (TCO).

The Logic: Cheap software often requires expensive implementation, more engineering hours, or third-party add-ons.

The Script:

"I understand that [Competitor X] has a lower sticker price. However, our data indicates that their base tier gates [Specific Feature A] and [Specific Feature B].

Most clients who start with them end up paying for third-party integrations to fill those gaps, which actually raises the total cost by about 20% compared to our all-in pricing.

Would you prefer a lower invoice today with unpredictable add-on costs later, or a guaranteed flat rate that includes the scale you need?"

Why it works: It uses specific intelligence (gated features) to reframe the lower price as a financial risk.

Script 2: The "Future-Proofing" Pivot (The Scalability Argument)

When to use it: When comparing your mature solution against a cheaper, early-stage entrant or a "good enough" incumbent.

The Logic: Consult the SaaS Competitive Maturity Model. If you are a Strategist and they are an Ostrich, highlight the gap in innovation velocity.

The Script:

"It’s true, they are cheaper right now. But we need to look at where your company will be in 12 months. We ship updates weekly based on user feedback (cite specific recent release).

[Competitor X] hasn't updated their core API documentation in six months. A lower price often signals a lack of investment in R&D.

Are you hiring us to solve today's problem, or to ensure you don't have to migrate your data again next year when they hit a ceiling?"

Why it works: It targets the anxiety of "tech debt" and migration pains, which are far more terrifying than a slightly higher monthly fee.

Script 3: The "Support as Infrastructure" Pivot (The Risk Argument)

When to use it: When the competitor cuts costs by automating support or offshoring success teams.

The Logic: In B2B SaaS, downtime costs more than software.

The Script:

"Our pricing includes a dedicated Success Manager and <1 hour response times. [Competitor X] offers email-only support with a 48-hour SLA for that price tier.

If your team gets stuck during the implementation next month, what is the cost of your team sitting idle for two days waiting for a reply?

We price for reliability. They price for volume. Which aligns better with your current project timeline?"

Why it works: It forces the prospect to quantify the cost of failure.

Battlecard Comparison: Static vs. Dynamic

To win consistently, you must upgrade your Battlecard format. Here is how the Old Way compares to the Agile Lensmor Way.

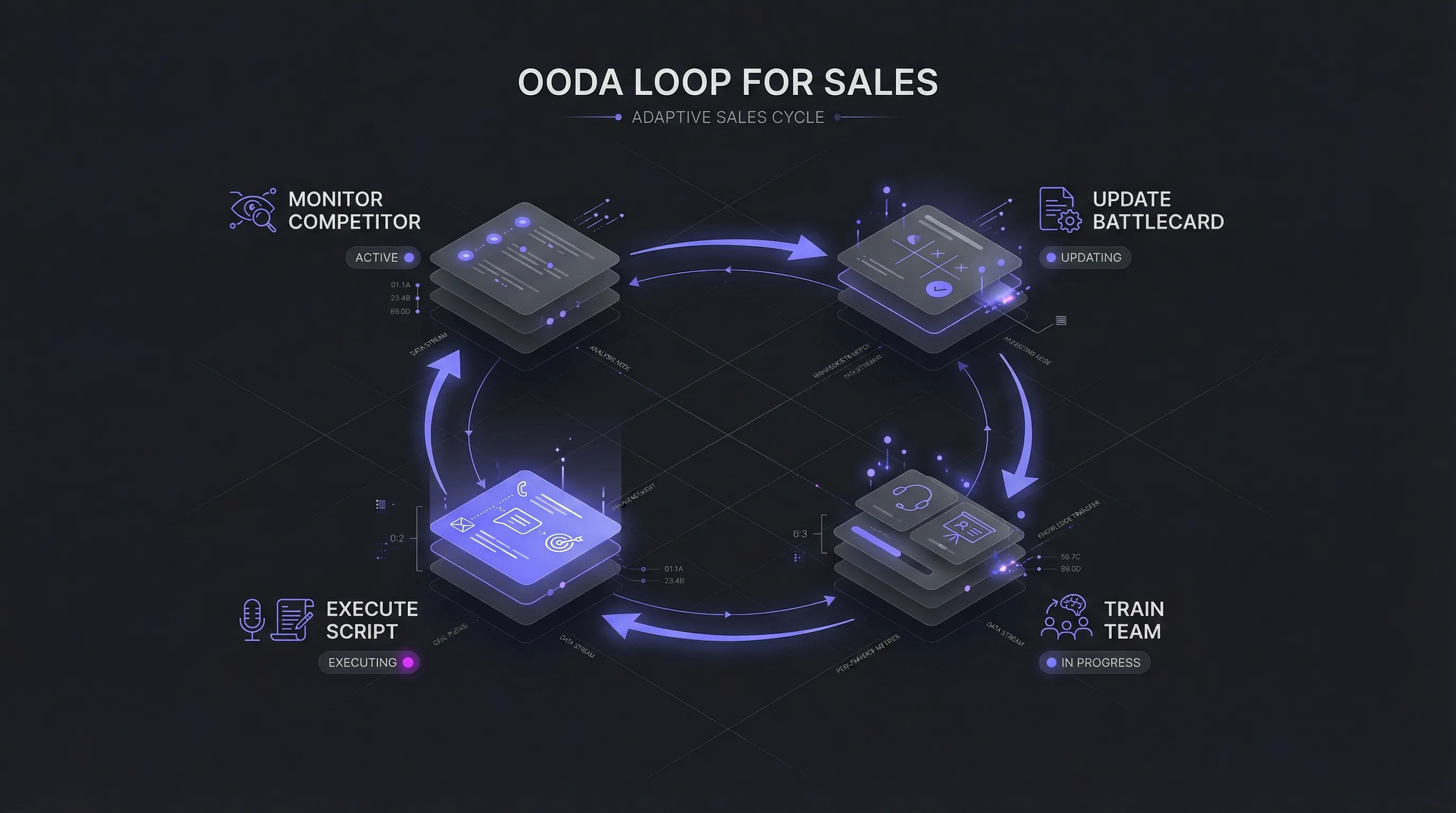

How to Build These into Your Workflow

You cannot expect reps to memorize these scripts. You need to operationalize them.

- Gather Intelligence: Use tools from the 2025 Market Intelligence Stack to monitor not just pricing changes, but packaging changes.

- Update the Battlecard: When a competitor drops a price, identify what they removed to make that math work.

- Train the Counter-Move: Review 7 Real-World Competitive Counter-Moves to ensure your team knows how to execute the pivot.

- Iterate: Use the SaaS OODA Loop (Observe, Orient, Decide, Act) to refine the scripts based on win/loss analysis.

Conclusion

A price objection is a request for help. The prospect is saying, "Help me justify paying more for you."

If your Battlecard only lists features, you will fail. If you use the scripts above to highlight hidden costs, scalability risks, and support gaps, you act as a consultant rather than a vendor.

Don't let your competitors dictate your value.

CTA

Ready to build a Battlecard that actually converts?[Download the Sales Battlecard Template] or Join the Lensmor Waitlist to automate your competitive intelligence gathering.

FAQs

Q: How often should we update our sales Battlecard?

A: In high-growth SaaS markets, a quarterly update is too slow. You should update your Battlecard whenever a major competitor changes pricing, packaging, or messaging. Using Agile CI tools allows for real-time updates, ensuring your sales team never uses expired data.

Q: Should we show the Battlecard to the prospect?

A: Generally, no. A Battlecard is an internal enablement document for your sales team. Showing it directly to a prospect can look defensive and petty. Instead, memorize the scripts and concepts within the card to guide the conversation naturally.

Q: What if the competitor really is cheaper and has feature parity?

A: If true, you have a product strategy problem, not a sales problem. Read our guide on Why Copying Competitors Will Kill Your Startup. However, usually, "feature parity" is a myth. Dig deeper into implementation time, API limits, or data retention policies to find the differentiation.

Q: What are the best tools to build a Battlecard?

A: While you can use Google Docs or Notion, dedicated competitive intelligence platforms are superior. Check out our review of the 9 Best Competitive Intelligence Tools for SaaS in 2025 to find the right fit for your stack.