TLDR:Most founders and PMMs waste 10+ hours a month building a static Competitive Intelligence Report that nobody reads. By the time you hit "send" on that PDF, the data is already obsolete. This post breaks down the 5 essential components of a modern report, provides a step-by-step execution plan, and explains why data-driven teams are ditching manual reporting for Agile CI and automated intent recognition.

The Audit Nightmare: Why You Hate Mondays

It’s 9:00 AM on Monday. You open Slack to a message from your CEO: "Did you see Competitor X just changed their pricing? Where was this in last month's update?"

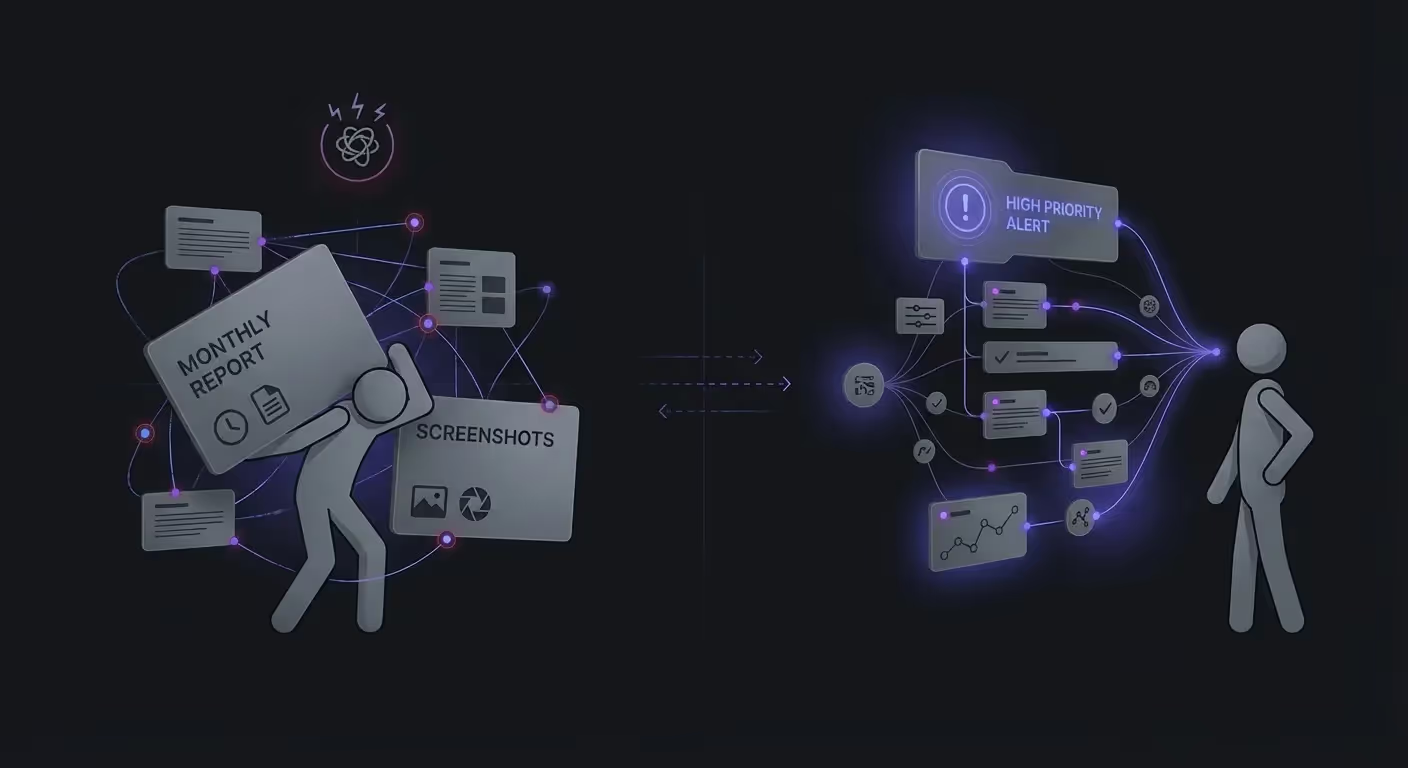

Your stomach drops. You spend the next six hours panic-scrolling through the competitor’s site, taking screenshots, and pasting them into a frantic Google Doc. You are reacting, not strategizing.

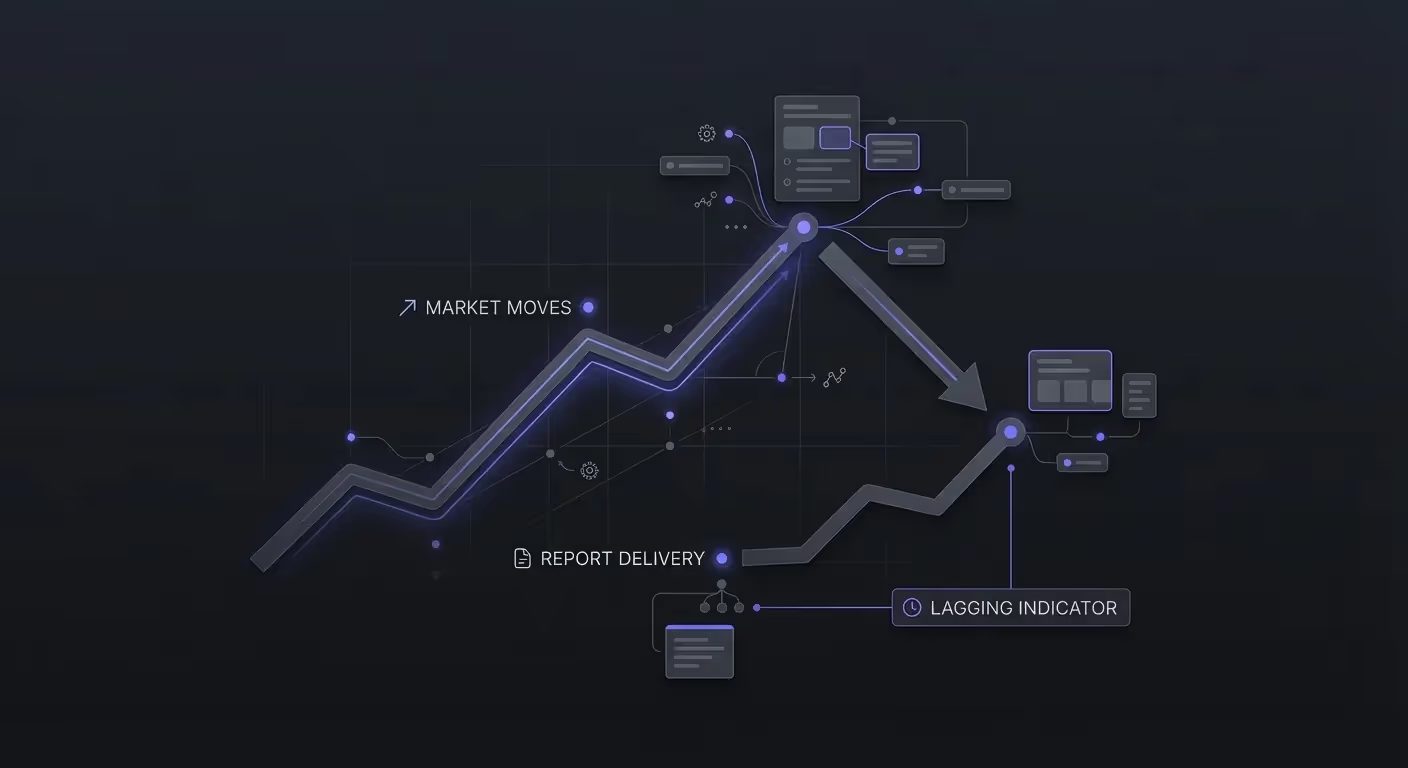

This is the "Old Way" of doing things. It relies on lagging indicators—reporting on things that happened weeks ago. It creates a culture of anxiety where you are constantly trying to explain what happened, rather than predicting what will happen.

At Lensmor, we believe this approach is broken. After monitoring thousands of SaaS sites, we found that 99% of "intelligence" gathered manually is just noise.

The goal isn't to document history; it's to change your future. Whether you are building your first report or trying to automate the process, this guide will show you exactly how to structure a Competitive Intelligence Report that actually moves the needle.

What is a Competitive Intelligence Report?

A Competitive Intelligence Report is a strategic document that synthesizes data regarding competitors' product changes, pricing shifts, and marketing maneuvers into actionable insights for stakeholders. unlike a raw data dump, an effective report filters out noise to focus on high-priority threats and opportunities that require an immediate decision.

Note: If your report doesn't contain a specific "Action Plan" for each insight, it’s not intelligence—it’s just news.

5 Key Components of an Effective Report

If you are following the The SaaS Competitive Maturity Model: Are You an Ostrich or a Strategist?, you know that gathering data is only step one. To move from "Ostrich" to "Strategist," your report must track these five pillars.

1. Market Positioning & Messaging Shifts

Has their homepage headline changed from "The Cheapest CRM" to "The AI-Powered CRM"? This signals a strategic pivot. You need to capture these H1/H2 changes immediately.

2. Product Updates & Launches

Don't just list new features. Analyze the intent. Are they closing a feature gap you previously exploited?

3. Pricing & Packaging Changes

Did they hide their Enterprise tier? Did they switch from per-user to usage-based pricing? Pricing is the highest-leverage lever in SaaS. A static Competitive Intelligence Report often misses the subtle changes in packaging that affect your win rates.

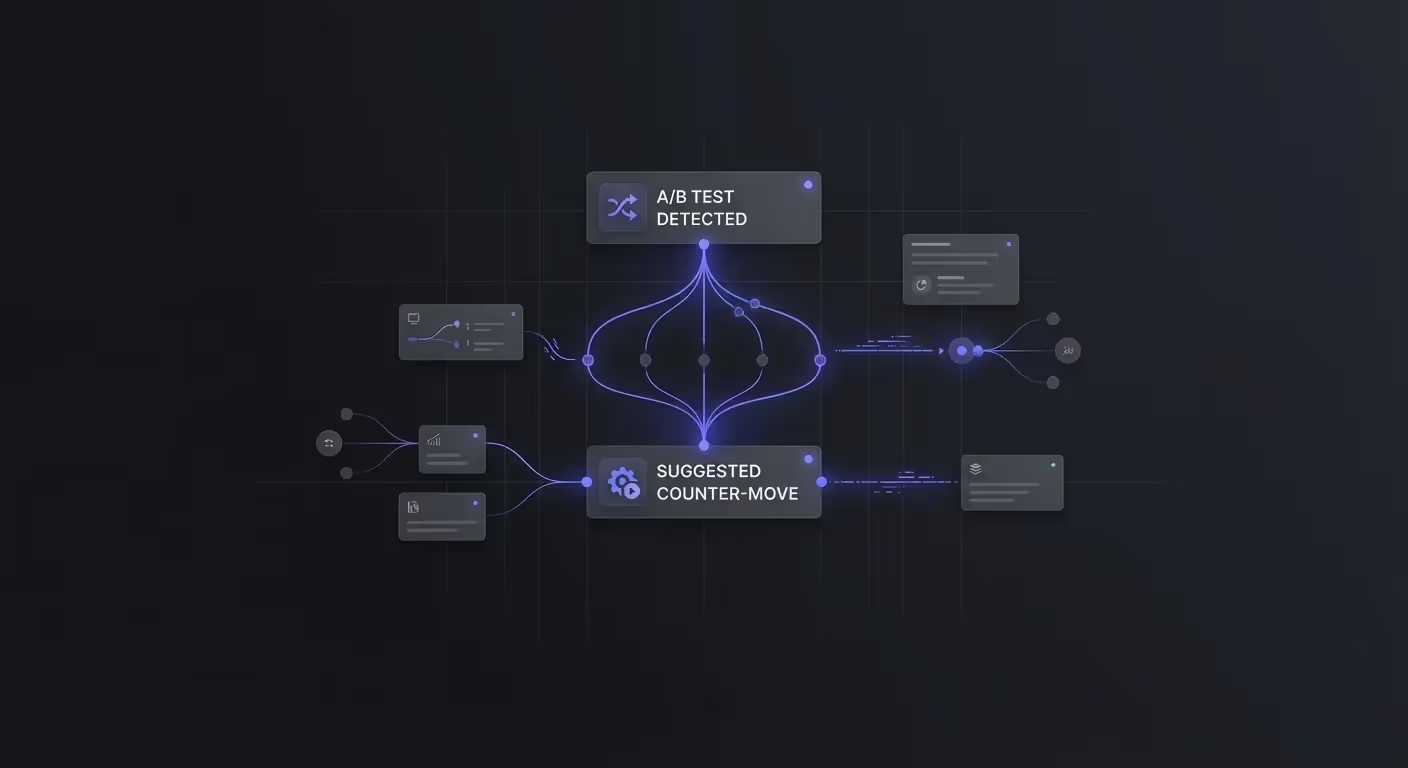

4. A/B Testing Experiments

This is the most overlooked component. Most tools only show you the final result. You need to know what they are testing right now.

- Lensmor Insight: Identifying a competitor's A/B test on their signup flow gives you a look into their future strategy before they roll it out globally.

5. Customer Sentiment (The "Gripes")

What are users complaining about on G2 or Capterra this week? This is your sales team's ammunition for battle cards.

How to Create a Competitive Intelligence Report (Step-by-Step)

If you are committed to the manual grind (before you switch to automation), here is the tactical playbook for building a comprehensive Competitive Intelligence Report.

Step 1: Define Your "Tier 1" Competitors

You cannot monitor everyone. Focus on the top 3-5 competitors who directly impact your revenue.

Step 2: Gather Data (The Manual Slog)

You will need to visit their Home, Pricing, and Product pages. Use tools like the Wayback Machine to compare against last month. Check their LinkedIn for new hires (which signal product direction).

Step 3: Analyze "Intent" vs. "Noise"

This is the hardest part. A font change is noise. A new "Integrations" page is intent. You must filter this manually.

Step 4: Distribute to Stakeholders

Don't just email a PDF.

- Sales: Needs "Kill shots" (quick one-liners).

- Product: Needs deep feature teardowns.

- Execs: Need high-level market shifts.

Why Traditional Reports are Failing (The Pivot)

Let's be honest: The traditional monthly Competitive Intelligence Report is an autopsy. It analyzes a body that has been cold for weeks.

Why the "Monthly PDF" model is dead in 2026:

- Latency: By the time you report a pricing drop, your sales team has already lost 10 deals.

- Context Switching: Founders don't want to read a 10-page doc; they want to know what to do right now.

- False Positives: Tools like Visualping alert you on every pixel change. This creates "alert fatigue," causing you to ignore the one signal that actually mattered.

"Static strategy is dead. The market moves too fast for monthly cadences. You need Agile Intelligence." — The Age of Agile Intelligence: Why Static Competitive Strategy is Dead in 2026

You need to move from "Reporting" to "Looping" (Observe, Orient, Decide, Act). Read more on this in our guide to The SaaS OODA Loop.

Automating Your Competitive Intelligence with Lensmor

Instead of spending 10 hours building a Competitive Intelligence Report, you should be spending 10 minutes reviewing Action Plans.

Lensmor replaces the manual grunt work with Agile CI. Here is how we do it differently:

1. Intent Recognition, Not Just Pixel Monitoring

Lensmor doesn't just tell you "the page changed." It uses AI to interpret the change. It tells you: "Competitor A is A/B testing a 20% price increase on their Pro plan."

2. Priority Scoring

We categorize alerts into High, Medium, and Low priority. You only get notified about the things that threaten your revenue.

3. Instant Action Plans

When a high-priority event is detected, Lensmor suggests an Action Plan.

- Scenario: Competitor launches a copycat feature.

- Lensmor Action: "Update Sales Battlecard #3 with differentiation point X."

Comparison: The Old Way vs. The Lensmor Way

Conclusion

Writing a Competitive Intelligence Report manually is a rite of passage for many marketers, but it shouldn't be your permanent state. The data shows that companies who react in real-time outperform those who wait for monthly summaries.

If you are tired of being the "screenshot intern" and want to become the "strategic advisor," it’s time to stop reporting on the past and start influencing the future.

Don't just watch your competitors—outmaneuver them.

Call to Action

Ready to automate your competitive intelligence?Join the Lensmor Waitlist today and get early access to our AI-driven insights engine.

Frequently Asked Questions (FAQs)

Q1: How often should I produce a Competitive Intelligence Report?

If you are doing it manually, a monthly cadence is standard, but often too slow for high-growth SaaS markets. However, with Agile CI tools like Lensmor, "reporting" becomes continuous. You should receive real-time alerts for high-priority items (like pricing changes) immediately, rather than waiting for a monthly compilation.

Q2: What is the most important part of a CI report?

The "Action Plan" or "Key Takeaways" section. A report without recommendations is just data. For every insight (e.g., "Competitor changed their H1"), you must answer "So What?" and "Now What?" Stakeholders need to know if they should ignore it, monitor it, or counter-attack immediately.

Q3: Can't I just use free tools for my Competitive Intelligence Report?

You can use tools like Google Alerts or visual pingers, but they lack context. As discussed in our review of 9 Best Competitive Intelligence Tools for SaaS in 2025, free tools result in high noise ratios. You will spend more time filtering false positives than analyzing actual strategy.